ABOUT NEW YORK LIFE Keeping a promise to help you protect and prosper for over 175 years

At the heart of New York Life is a commitment to be there for our customers when they need us—whether today or decades into the future. Since 1845, we have delivered on that promise by investing wisely, managing finances strategically, and remaining true to our mission as a mutual company.

There for you when you need us most

We know your family is everything to you, and we’ll do everything we can to help you protect what really matters–like your lifestyle and your financial future.

We have a legacy of stability

Our greatest legacy at New York Life is helping others protect their legacies for generations—serving policy owners for 175+ years, in good times and bad

We have the highest financial strength rating

New York Life has earned the highest financial ratings of all four major ratings agencies, based on our history of honoring our commitments to policy owners1

We are the largest mutual insurer in the U.S.

New York Life is the nation’s largest mutual life insurance company, and our policy owners are at the center of everything we do2

We answer to our policy owners, not to Wall Street

New York Life is a mutual company, meaning we are not traded on the stock exchange, we don't have shareholders, and we don't answer to Wall Street. We answer to and operate for the benefit of current and future policy owners.

Putting your needs first

We’re focused on fulfilling our promises and doing what's best for policy owners, not on delivering profits for others

Focusing on the long term

We make decisions from a long-term perspective, meaning we plan for the next quarter century (not just the next quarter)

Consistently paying dividends

New York Life has paid dividends to customers for more than 167 years consecutively, including $2 billion in 2023 alone3

136,000+

hours volunteered by NYL employees and agents

$32.15M

in total philanthropic giving in 2022

$2.1M

in volunteer grants to support employees’ local communities

58.7%

of our workforce are women4

42.4%

of our corporate employees are people of color4

50%

of our Board of Directors are women or people of color4

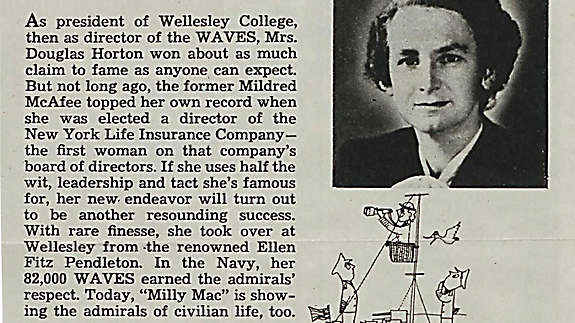

Industry leaders throughout the years

1The “highest ratings currently awarded” refers to the highest ratings currently awarded to any U.S. life insurer, specifically: AM Best A++ (as of 9/30/2022), Fitch Ratings AAA (as of 11/4/2022), Moody’s Aaa (as of 6/17/2022), and Standard & Poor’s AA+ (as of 7/29/2022). Source: third-party reports. Learn more: https://www.newyorklife.com/about/our-strength/what-rating-agencies-say.

2Based on revenue as reported by “Fortune 500 ranked within Industries, Insurance: Life, Health (Mutual),”Fortune magazine, 6/5/2023. For methodology, please see https://fortune.com/franchise-list-page/fortune-500-methodology-2023/.

3Dividends are paid on participating policies and are based on the policy's applicable dividend scale, which is neither guaranteed nor an estimate of future performance results.

4Stated figures are as of 12/31/22.