What is dollar cost averaging?

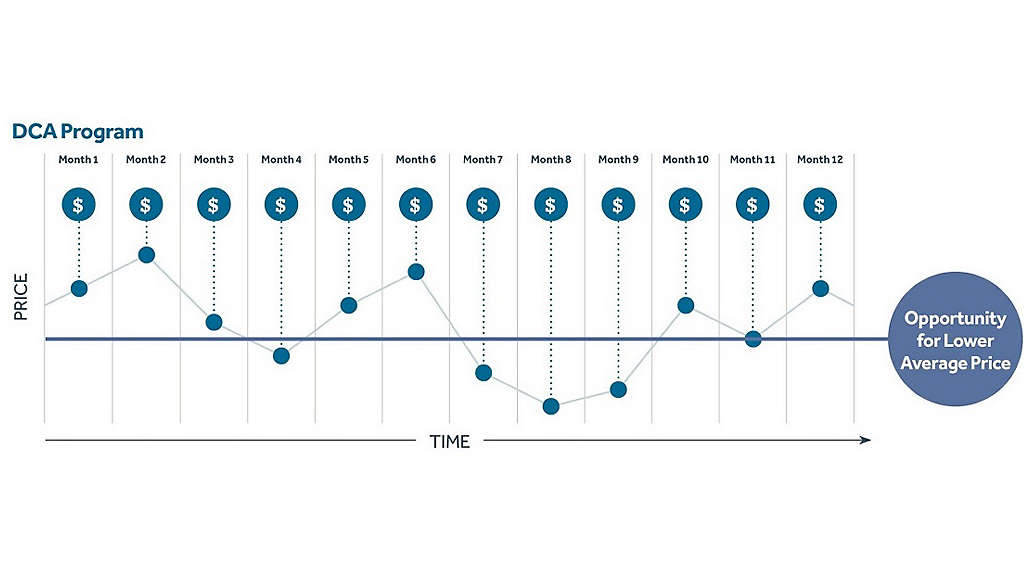

Dollar cost averaging (DCA) is an investment strategy that involves systematically investing an amount of money with which you are financially comfortable over consistent periods in order to reduce the average share price you pay in relation to the average market price of the shares. You invest the same amount whether the market is rising or falling. 1 Instead of investing a lump sum all at once, you make regular fixed-dollar investments at predetermined intervals.

Dollar cost averaging example

Trying to time the market and invest when prices are low can be challenging and risky. Dollar cost averaging addresses this problem by automatically investing the same amount over time, thus buying more shares of an asset when prices are low and fewer when prices are high.1

Advantages of dollar cost averaging

Dollar cost averaging offers several advantages for investors who are looking to build their portfolios over time.

1. Reduced impact of market timing

Trying to time the market can be difficult even for experienced investors, but consistently investing fixed amounts over time can help you avoid making large investments when price points are higher. Of course, dollar-cost averaging does not ensure a profit or eliminate the risks of investing.

2. Emotional discipline

Dollar cost averaging provides a more disciplined approach to investing, and it can help investors make fewer impulse decisions based on short-term market fluctuations or emotional reactions to market news.

3. Lower average purchase price

Since you automatically buy more shares or units of an asset with dollar cost averaging when prices are lower and fewer when prices are high, this leads to a lower average purchase price over time. This could potentially increase your overall gains if the market trends upward.

4. Reduced impact of volatility

This strategy’s regular investing schedule means you’re buying during both bull and bear markets, reducing the risk of making a large investment right before a market downturn.

5. Simplicity and consistency

Dollar cost averaging is a straightforward investment strategy. You set up automated investments, and they occur on a regular basis without your needing to monitor constantly or make frequent decisions. This also reduces the stress and anxiety associated with timing the market or making large lump-sum investments.

6. Long-term perspective

Dollar-cost averaging encourages investors to take a long-term view of their investments. This can potentially enable you to benefit from the compounding of interest during any extended market upturns. Of course, it’s also possible to lose money in a dollar-cost averaging program.

7. Accessibility

It’s accessible to investors with various levels of financial resources. You can start with smaller investment amounts and increase them as your financial situation improves.

8. Consistent savings

This serves as a way for you to save since it encourages you to regularly contribute to your investment portfolio. This is particularly valuable for those who find it challenging to save significant sums.

9. Incorporation into your financial strategy

You can easily incorporate dollar cost averaging into your financial planning, which makes it suitable for retirement accounts, college savings plans, and pursuing other long-term financial goals.

Variable universal life investment

Variable universal life offers life insurance protection and the opportunity to grow tax-advantaged assets in the market. For greater confidence, the New York Life Variable Universal Life Accumulator II offers two special dollar cost averaging accounts that offer a guaranteed interest rate as your money waits to enter the market. Variable universal life insurance provides a life insurance benefit in exchange for flexible premiums. The policy’s cash value will fluctuate with investment gains or losses. Mortality-and-expense risk charges, cost-of-insurance charges, per thousand face amount charges, monthly contract charges, fund fees, and applicable surrender charges apply. Please carefully consider the investment objectives, risks, charges, and expenses before investing. This and other information can be found in the product and underlying funds prospectuses. Please read the prospectuses carefully before investing or sending money.

DCA Plus Account

Earn a guaranteed interest rate on assets in the account as they wait to enter the market in the first 12 months of your policy. The rate is subject to change at any time, but it will never be less than an annual rate of 2%. Your New York Life financial services professional can tell you what the current rate is.2

DCA Extension Account

Earn a guaranteed interest rate on assets in the account—up to the conclusion of year 7 of your policy—as they wait to enter the market. This account is available for premiums of $10,000 or more. The rate is subject to change at any time, but it will never be less than an annual rate of 2%.2

RELATED CONTENT

Want to learn more about investment strategies?

A NYLIFE Securities Registered Representative can help determine what’s right for you.

1Dollar-cost averaging may help investors achieve a lower average purchase price, but it does not guarantee a profit, nor does it protect against loss. Investors should consider their ability to continue making purchases through periods of low prices.

2All guarantees are based on the claims-paying ability of the issuer. The rate is paid only while the assets remain in the DCA Plus or DCA Extension Account waiting to be transferred, and when the balance in the account declines, the account will not achieve the declared annual effective rate. Once money is transferred into the Investment Divisions, it will be subject to market risk and will fluctuate in value.

The DCA Plus Account and DCA Extension Account interest rates should not be used as the sole criteria for purchasing a policy. Investors should consider buying a variable universal life product only if it makes sense because of its combination of features, including life insurance protection.

The DCA Plus Account is available only at the time of issue and with an initial net premium of at least $1,000. The minimum premium for the DCA Extension Account is $10,000. Transfer limitations into and out of the accounts apply. Please consult with your New York Life financial services professional or the prospectus for more information.

In most jurisdictions, the form number for New York Life Variable Universal Life Accumulator II is ICC17-317-30. State variations may apply.

Variable universal life products are issued by New York Life Insurance and Annuity Corporation (A Delaware Corporation) and are distributed by NYLIFE Distributors LLC, Member FINRA/SIPC. Both NYLIAC and NYLIFE Distributors LLC are wholly owned subsidiaries of New York Life Insurance Company.