Birth Year

Make the most of your social security benefits

Guidance on when to claim benefits based on your personal needs.

by Mary Beth Franklin, CFP

Executive summary

Deciding when and how to claim Social Security benefits is one of the most important decisions that retirees will ever make.

Social Security represents the single largest source of income for the majority of older Americans, accounting for half or more of total retirement income for 42% of women and 37% of men, according to the Social Security Administration. And for some elderly beneficiaries, Social Security is the source of 90% of more of their total income*.

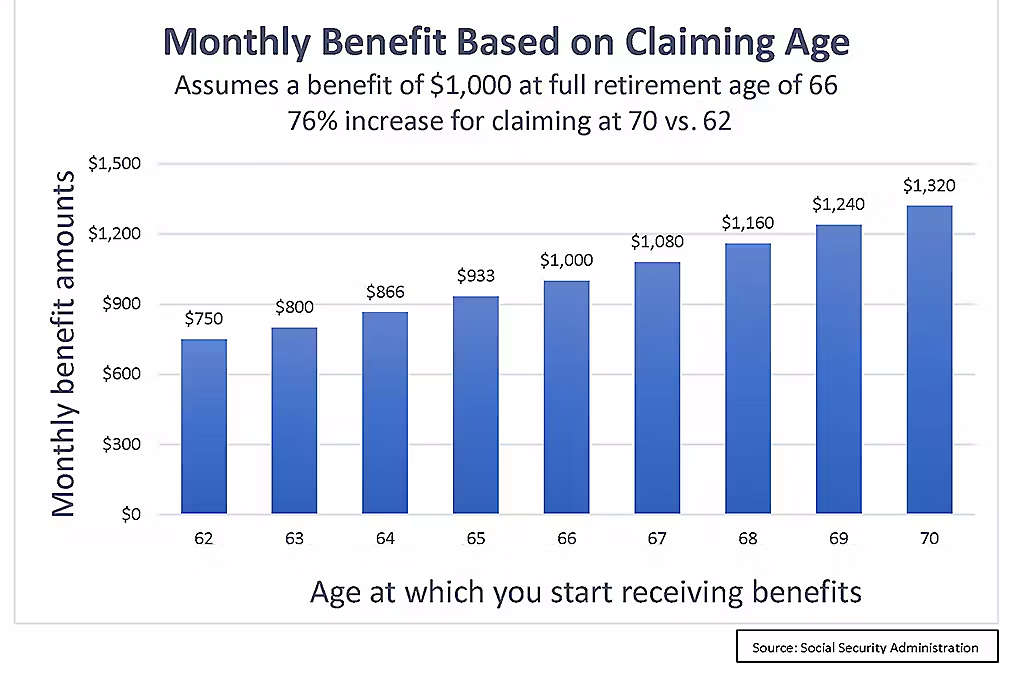

Social Security benefits represent one of the few sources of guaranteed income that retirees can count on for the rest of their lives. You can claim Social Security anytime between age 62 and 70, but the longer you wait to start benefits, the bigger your monthly benefits will be for the rest of your life.

While there has been a growing appreciation of the value of maximizing Social Security benefits in recent years by delaying benefits, the coronavirus pandemic and its disruptive impact on work patterns has prompted some Americans to rethink their previously planned Social Security claiming strategy to meet immediate income needs. Some people lost their job during the pandemic and subsequent recession while others voluntarily retired due to health concerns.

In addition, some people want to claim Social Security as soon as possible out of fear that benefits could be cut in the future if the Social Security trust funds run dry before Congress can step in to shore up the system’s long‐term finances. Social Security is an extremely popular and highly effective retirement income program and it is highly unlikely that lawmakers would cut benefits for near or current retirees. Claiming reduced benefits early out of fear is a bit like selling stocks in a down market: you are guaranteed to lock in a loss.

One of the most valuable features of Social Security is the benefits are indexed to inflation to help preserve buying power. In 2023, benefits increased by a whopping 8.7%, the biggest cost‐of‐living adjustment in 40 years. Subsequently, inflation slowed and Social Security benefits increased by a more typical 3.2% in 2024. But there is no need to rush to claim Social Security benefits in order to lock in a cost‐of‐living adjustment (COLA)**. Every COLA that is awarded from the time you become eligible for Social Security at 62 until you file for benefits will be automatically included in your future monthly benefit.

* https://www.ssa.gov/news/press/factsheets/basicfact‐alt.pdf(2024)

** https://www.ssa.gov/news/press/factsheets/colafacts2024.pdf

The following article explains:

- basic rules for claiming Social Security benefits.

- consequences of claiming reduced benefits early.

- possible remedies for reversing those claiming decisions in the future.

- and the value of delaying benefits for those who can afford to wait.

Your Age Matters

The dollar amount of your monthly Social Security benefit is based on your lifetime earnings. Your actual earnings are adjusted to account for changes in average wages since the year the earnings were received. Social Security calculates your average indexed monthly earnings during your top 35 earning years and applies a formula to those earnings to arrive at your basic benefit or “primary insurance amount” (PIA). This is how much you would receive at your full retirement age, which varies from 66 to 67, depending on your year of birth.

Many of the creative claiming strategies that allowed married couples and eligible divorced spouses to maximize their lifetime benefits in the past have disappeared for new retirees. But the decision about when to claim Social Security benefits is still a critical piece of the retirement income puzzle. And many widows and widowers will continue to have flexible claiming options, regardless of when they were born.

The age at which you claim your benefits determines your monthly payment. If you claim benefits before your full retirement age, your benefit will be reduced. If you are willing to delay claiming your benefits, up to age 70, they will be larger for the rest of your life. The table below illustrates the effect of claiming Social Security benefits early, assuming a $1,000 per monthly primary insurance (PIA) amount at full retirement age.

Decrease in Benefits for Claiming Early Assumes $1,000 PIA at Full Retirement Age (FRA)

|

66 |

$750 |

25.00% |

|

|

66 and 2 months |

$741 |

25.83% |

|

|

66 and 4 months |

$733 |

26.67% |

|

|

66 and 6 months |

$725 |

27.50% |

|

|

66 and 8 months |

$716 |

28.33% |

|

|

66 and 10 months |

$708 |

29.17% |

|

|

67 |

$700 |

30.00% |

|

|

Source: Social Security Administration |

On the other hand, if you are willing to postpone claiming benefits, you will be rewarded for your patience. For every month you wait to collect Social Security beyond your full retirement age you earn delayed retirement credits worth 0.66% per month for a total of 8% per year, up to age 70.

For someone whose full retirement age (FRA) is 66, delaying Social Security benefits until 70 will result in a whopping 32% increase in benefits. That means if your FRA benefit is $2,000 per month at age 66 and you wait until 70 to collect, your benefits will grow by 8% per year for four years and be worth $2,640 per month at 70 ($2,000 x 1.32).

The actual payout will be even larger as annual COLA for each of the intervening years between the time you first become eligible for benefits at 62 and the age you claim will be added to your monthly benefit amount. Waiting to collect the biggest benefit at age 70 means future COLAs will be applied to a bigger base, resulting in larger monthly payments for the rest of your life. Delayed retirement credits end when you turn 70, so it makes no sense to postpone claiming Social Security beyond that age.

How Work Affects Benefits

Anyone who collects Social Security benefits before full retirement age—including retired workers, their spouses, divorced spouses, and survivors—are subject to earnings restrictions if they continue work while receiving benefits. The earnings cap applies only to wages from a job or net self‐employment income, not other sources of income such as investments, pensions, other government benefits or payment for work you completed before retirement.

In 2024, you lose $1 in benefits for every $2 earned over $22,320 if you are younger than FRA for the entire year. The earnings cap is indexed to inflation and increases in years when there is a COLA.

Let’s say you are 62 and are eligible to collect $1,250 per month in Social Security benefits for a total of $15,000 per year. Assume you claim benefits early and you continue to work. If you expect to earn $40,000 from that job, that’s $17,680 over the earnings limit ($40,000 ‐ $22,320 = $17,680) so you would forfeit half of that excess amount ‐‐$8,840 in benefits.

The Social Security Administration would withhold your first eight months of benefits ($1,250 x 8 = $10,000) due to excess earnings and would send your full benefits in September, October, November, and December. SSA would refund the excess $1,160 it withheld this year to satisfy the earnings cap ($10,000 ‐ $8,840). SSA cannot withhold partial monthly payments. The following year, the clock would begin again with the new annual earnings limit.

A more generous earnings cap applies in the year you reach FRA. In the months before reaching your full retirement age, you can earn up to $59,520 without sacrificing any Social Security benefits. If you earn more than that, you’ll forfeit $1 in benefits for every $3 earned over the limit.

In 2024, the full retirement age increases to 66 and 8 months for some people who were born in 1958. Individuals who were born in the first four months of 1958 will reach their full retirement age in 2024. Those born in subsequent months of 1958 will attain their full retirement age in 2025. The gradual increase of two months per year will continue until the full retirement age reaches 67 for those born in 1960 and later. The final phase of the full retirement age increase will take effect three years from now for people who turn 67 in 2027 and beyond.

Once you reach FRA, the earnings cap disappears, meaning you can continue work without reducing your Social Security benefits.

Benefits lost to the earnings cap are not gone forever, they are merely deferred. For example, say you claimed retirement benefits at 62 and continue to work. And assume over the next four years, you forfeited 24 months of Social Security benefits due to excess earnings. When you reach your full retirement age, SSA will recalculate your benefits, adding back any months you forfeited because of the earnings cap. Going forward, SSA would pay you a larger monthly benefit as if you had claimed at age 64 rather than 62 (62 + 24 months of forfeited benefits).

Sometimes people who retire in midyear may have already earned more than the annual earnings limit. That’s why there is a special rule that applies to earnings in the first year in retirement as was the case for thousands of older workers who lost their jobs due to the pandemic‐induced recession.

Under this rule, you can get a full Social Security check for any whole month you are retired, regardless of your yearly earnings. In 2024, a person younger than full retirement age for the entire year is considered retired if monthly earnings from a job are $1,860 or less, which is the annual earnings limit of $22,320 divided by 12.

For more information, see “How Work Affects Your Benefits”.

Your Marital Status

It’s not just your age and earnings history that can affect your Social Security benefits. Your marital status can also influence your lifetime benefits.

When an unmarried individual claims Social Security benefits, it’s fairly simple. Their benefit is be based on their average lifetime earnings and the age when they first claimed benefits. Some married couples have an additional claiming option, as do some eligible divorced spouses, depending on their birth date.

Widows, widowers and surviving ex‐spouses have the most flexibility when it comes to Social Security claiming strategies because they may be entitled to two benefits: retirement benefits and survivor benefits, which are considered two separate pots of money. Eligible beneficiaries may be able to claim one type of benefit first and switch to the other later if it would result in a bigger monthly benefit.

Married couples should coordinate their claiming strategies to maximize benefits while both spouses are alive and to create the largest possible survivor benefit for the remaining spouse after the first one dies.

In general, it makes sense for the spouse with the larger Social Security benefit to delay claiming up until age 70 to maximize the household’s retirement benefit. In the meantime, the spouse with the smaller benefit may want to claim reduced benefits early if he or she is not working or at full retirement age when earnings restrictions disappear. This coordinated claiming approach generates some income initially, helping to take some pressure off the couple’s finances while the second spouse waits until 70 to claim a maximum benefit.

A married individual may be entitled to two Social Security retirement benefits: one on their own earnings record and one as a spouse, which is worth up to 50% of the worker’s full retirement age benefit. Normally, Social Security pays the larger of the two benefits.

For example assume a husbands FRA benefit at 66 is $2,400 per month. A spousal benefit would be worth half of that amount--$1200 per month— if the wife claimed benefits at her FRA; less if she claimed earlier. Let's assume she has also earned her own retirement benefit of $1,000 per month.

Assuming the husband and wife each claim Social Security at their FRA, the wife would receive the higher of the two amounts--$1,200 in this case. Her benefit would actually be comprised of two components: her own benefit of $1,000 per month plus the excess spousal benefit amount of $200 per month.

How Spousal Benefits Are Reduced If Claimed Before FRA Spousal Benefit Worth up to 50% of Worker’s FRA Amount

|

62 |

35% |

32.5% |

|

63 |

37.5% |

35% |

|

64 |

41.7% |

37.5% |

|

65 |

45.8% |

41.7% |

|

66 |

50% |

45.8% |

|

67 |

50% |

50% |

|

Source: Social Security Administration |

If one spouse has not worked long enough—at least 10 years to accrue the minimum of 40 credits needed to be eligible for benefits—she can still claim benefits as a spouse. But she must wait until her husband claims his Social Security benefit before she can claim a spousal benefit based on his earnings record.

If the spouse with the bigger benefit dies first, the larger benefit –the husband’s $2,400 per month in this example— would continue as the survivor benefit and the wife’s smaller retirement benefit of $1,200 per month would disappear. The major goal of most couple’s claiming strategy should be based on creating the largest possible survivor benefit.

Until last year, there was an additional claiming option available for married couples where at least one spouse was born before 1954. Once one spouse filed for Social Security, the other spouse, who was at least 66 years old and who was born before 1954, could file a “restricted claim for spousal benefits” and collect half of the other spouse’s FRA amount while allowing his or her own retirement benefit to continue to grow up until age 70 and then switch to the bigger benefit.

However, the last eligible group of people who could take advantage of this valuable claiming strategy turned 70 in 2023, the maximum age for claiming retirement benefits. As a result, this method of coordinating claiming strategies to maximize lifetime benefits for married couples and in some cases, eligible divorced individuals, has effectively been eliminated.

People who were born after January 1, 1954, cannot use this strategy of claiming spousal benefits first and switching to maximum retirement benefits later. Whenever they file for Social SMRU 6531017(exp 4/1/2025) Security, they will receive the largest benefits to which they are entitled at that age, whether on their own earnings record or as a spouse. They don’t get to choose.

Collect on Your Ex

Divorced spouses who were married at least 10 years and who are currently unmarried may be able to collect benefits on an ex’s earnings record. Like the married couple in the previous example, if an ex‐spouse is eligible for retirement benefits on her own earnings record and as a former spouse, she would be paid the higher of the two amounts.

Also, like the married couple above, an eligible divorced spouse who was born on or before January 1, 1954, could have filed a restricted claim for spousal benefits on her ex‐husband’s earnings record. In the past, that would have allowed her to collect half of her ex‐husband’s FRA amount while her own retirement benefit would continue to grow up until age 70 when she would switch to her own maximum benefit. But as all eligible individuals who were born before 1954 are now at least 70 years old—the age when one can claim maximum Social Security retirement benefits—this strategy is no longer valid.

Divorced spouses born after January 1, 1954, cannot use this restricted claiming strategy. Whenever they file for Social Security, they would be paid the largest benefit to which they are entitled at that age, whether on their own earnings record or as a spouse. They don’t get to choose.

When it comes to filing for Social Security, divorced spouses have one advantage over married couples. A divorced spouse who was married at least 10 years, has been divorced at least two years and who is currently single can claim benefits on an ex’s earnings record even if the ex has not yet claimed benefits—assuming that spousal benefit amount is larger than her own retirement benefit. Both former spouses must be at least 62 years old. This is known as being an “independently entitled ex‐spouse”.

Survivors

Widows, widowers and surviving ex‐spouses have more flexibility than other Social Security beneficiaries because retirement benefits and survivor benefits represent two different pots of money. A surviving spouse or surviving ex‐spouse can choose one benefit first and switch to the other benefit later if it results in a large monthly benefit, regardless of year of birth.

To be eligible for a Social Security survivor’s benefit, a widow or widower must have been married to the deceased worker for at least nine months at the time of his or her death. An eligible surviving ex‐spouse must have been married to the deceased worker for at least 10 years before the divorce.

Survivor benefits are available as early as age 60, but they would be worth just 71.5% of the deceased worker’s benefit compared to 100% if the survivor claimed benefits at his or her full retirement age. Survivor benefits are worth the maximum amount when collected at FRA. They do not continue to grow. But retirement benefits increase by 8% per year for every year benefits are delayed beyond full retirement age, up to age 70.

A widow or widower could choose to collect a reduced survivor benefit as early as age 60 and switch to a maximum retirement benefit as late as age 70, subject to earnings restrictions if claimed before FRA while continuing to work. If the survivor benefit is the larger benefit, it may make sense to collect reduced retirement benefits early and switch to maximum survivor benefits at FRA.

If a widow, widower or surviving ex-spouse waits until age 60 or later to remarry, they can collect a survivor benefit even if they are married to someone else.

Do-Over Options

Anyone has the right to change their mind about claiming Social Security by withdrawing their application (Form 521) within 12 months of first filing for benefits. But there’s a catch. They must repay any benefits they have received as well as any benefit collected on their earnings record by a spouse or minor or disabled children.

That resets the clock as if they never claimed Social Security so they will receive a larger benefit when they file at a later date. You can only withdraw your application for benefits once in a lifetime.

If you miss the 12-month widow, you have another do-over option. You can suspend your benefits. You do not have to repay any benefits. Your monthly payment will stop, along with those of anyone claiming benefits on your record (except an ex-spouse). Your benefit will then earn delayed retirement credits of up to 8% per year up until age 70.

The math works like this. Assume you were entitled to $2,000 per month at your FRA of 66 but you filed for benefits early at 62 and they were reduced by 25% to $1,500 per month. You collected benefits for four years and then suspended them at 66. Your benefit would grow by 8% per year for four years (32%). At 70, your benefits would be worth 99% of your FRA amount (75% x 1.32 = 99%), effectively restoring your FRA amount. If you died first, that is what your widow or widower could receive as a survivor benefit.

Post COVID-19 Claiming Strategies

Some individuals who had planned to delay claiming Social Security benefits until later may have reconsidered their claiming strategy amid the COVID‐19 pandemic and resulting economic challenges. Perhaps they lost their job and need income now. Or they are worried about their health and are afraid to return to work.

You have worked long and hard for your Social Security benefits, contributing to FICA payroll taxes throughout your career to fund your future benefits. If you really need money now and want to claim early, go ahead. It’s your money. If you need it, take it.

Just be aware if you claim before FRA, your retirement benefits will be reduced, which could also affect potential survivor benefits.

If you leave your job mid‐year, you may be able to take advantage of the first‐year‐in‐retirement rule would allow you to collect Social Security benefits even if you have already earned more than the 2024 annual earnings limit of $22,320 and long as you have little or no earned income during the remainder of the year. But if you earn more than $1,860 in any single month‐‐which is 1/12 of the annual earnings limit of $22,320‐‐you would not receive a Social Security benefit for that month.

And, if your financial situation improves in the future, you may be able to suspend your benefit at FRA or later and earn delayed retirement credits of 8% per year up to age 70.

But if you are thinking about claiming benefits early just because you are worried about an uncertain future or you are concerned that the Social Security trust funds will run dry in the future if Congress doesn’t step in to authorize needed reforms, think again. Even though interest rates on savings and fixed‐income investments have increased over the past few years, Social Security’s delayed retirement credits of 8% per year is still hard to beat. If you can afford to wait, you will be rewarded for your patience, locking in a larger guaranteed monthly benefit for the rest of your life.

About the author

Mary Beth Franklin is one of the country’s leading experts on Social Security and Medicare.

An award‐winning journalist and Certified Financial Planner, Mary Beth is a former Contributing Columnist at Investment News, a publication for financial advisers, where she wrote a column on retirement issues. She is also author of the ebook, Maximizing Your Social Security Benefits, which is available for $29.95 at www.MaryBethFranklin.com. Previously, Mary Beth was the tax and retirement editor for Kiplinger’s Personal Finance magazine. Earlier in her career, Mary Beth was a Capitol Hill reporter focusing on federal budget and tax policy issues and Social Security reform. She is a frequent guest on numerous radio and television programs.

The Author of this material is solely responsible for its content. It is distributed for informational purposes only and is not intended to constitute the giving of advice or the making of any recommendation to purchase a product. New York Life Insurance Company, its affiliates and subsidiaries, and agents and employees do not provide legal, tax or accounting advice. Individuals should consult with their own professional advisors before implementing any planning strategies.