Drawdown risk is the possibility that you’ll outlive your savings by withdrawing too much money from your retirement savings accounts too quickly.

Sequence-of-returns risk in retirement

Do you have enough money set aside to enjoy a long and comfortable retirement? It’s hard to know for sure—especially with all the economic forces that could affect your nest egg. While some, like inflation, are well known, this article explores an equally serious—but less familiar—hazard called sequence-of-returns risk (also known as sequencing risk).

What is sequence-of-returns risk?

We all know that the market has ups and downs, and during your working years it’s a good idea to ride out that volatility rather than try to time the market. Sequence-of-returns risk refers to the fact that the timing (or sequence) of those ups and downs while you’re making withdrawals in retirement may have a negative impact on your portfolio.

Why does the order (sequence of returns) matter?

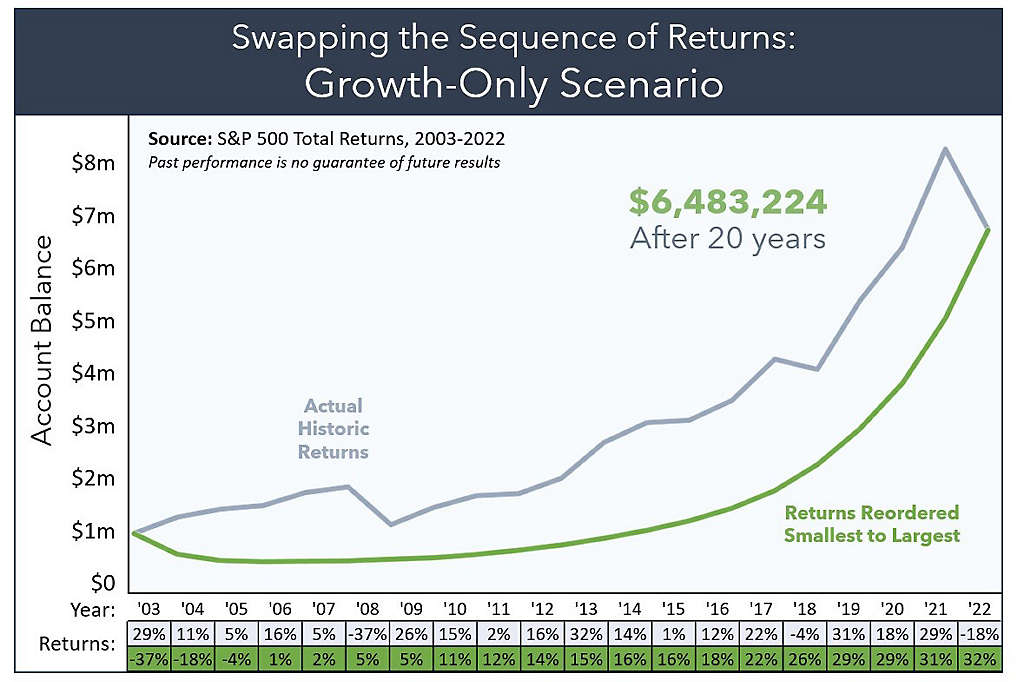

The sequence of returns doesn’t matter as much when you’re in your “accumulation years” and letting your money grow without making withdrawals. Consider this example, which shows the growth of $1 million in the S&P 500 index from 2003-20221. The grey line shows the growth based on the actual returns during that time period. The green line shows what would have happened if the order of those annual returns had been rearranged – in this case, with the worst years happening at the beginning and the best ones happening at the end of the 20-year sequence.

The alternate scenario starts terribly, with the -37% returns of the 2008 market crash happening in the very first year, bringing the balance down by $370,000 in a single year. But as you can see, the final balance at the end of this 20-year sequence is exactly the same as in the actual market scenario. The two charts take a different path to get there, but they end up in the same place.

Things are very different in retirement.

Whenever you take money from your retirement account, you’re selling assets (stocks, bonds, etc.) to support your lifestyle. If the market drops early in retirement, your assets will be worth less and you’ll need to sell more of them to generate the money you need. Unfortunately, this sell-off means you’ll have fewer assets to rely on later in life and could miss out on a lot of growth if the market eventually recovers. If, on the other hand, the market drops toward the end of retirement, you’ll have enjoyed years of steady returns—which can help offset the impact of any withdrawals and losses.

Here’s an example of sequencing risk in retirement

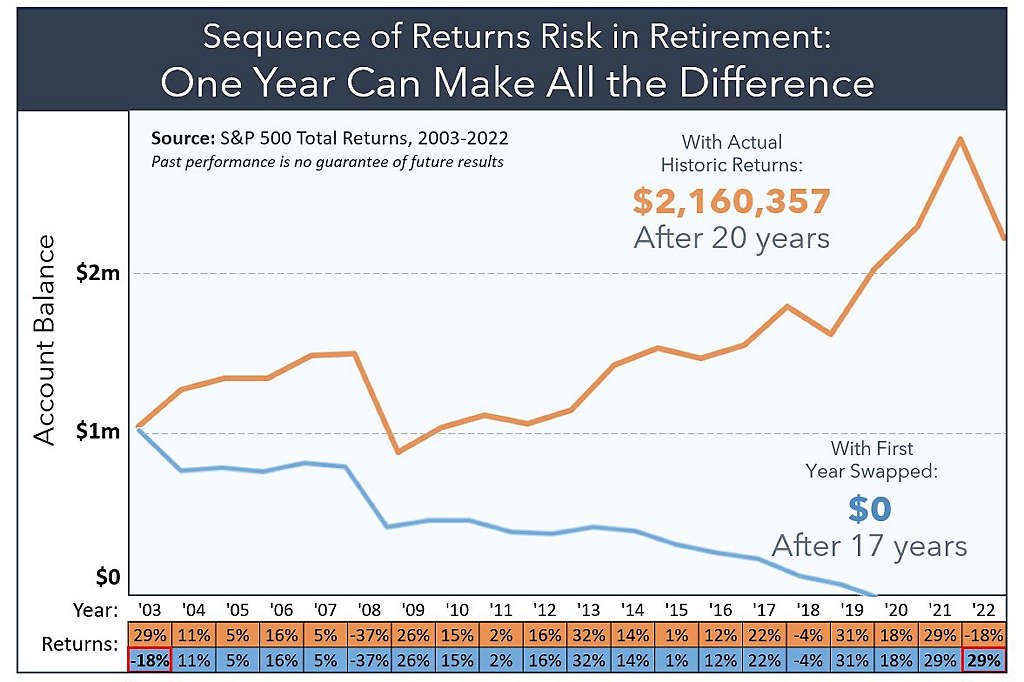

They say timing is everything in life, and that’s especially true when it comes to your retirement. Let’s look at the impact sequence-of-returns risk has on two identical retirement accounts. In this example, both retirees start with $1 million in their retirement account, invested entirely in the S&P 500 at the beginning of 2003. (In reality, that would be too aggressive an asset allocation for a retiree, but it makes the example easier.) Each withdraws $60,000 a year by selling shares. The only difference between the two accounts is that the owner of the first account (as depicted in the below chart by the orange line) experiences the actual sequence of returns during this time period, while the owner of the second account (as depicted by the blue line) sees a slightly different sequence. Specifically, the returns in year 1 and year 20 of the sequence are swapped, which means that they experience an 18% drop in their first year of retirement, rather than a 28% gain.

Even though the total average returns are the same, that one change in the sequence makes all the difference:

As you can see, the owner of the second account runs out of money by year 17—simply because they encountered a down market much earlier in retirement. That’s sequence of returns risk in a nutshell.

How do I protect my portfolio from sequence-of-returns risk?

While a market downturn is beyond your control, there are a few steps you can take to reduce the impact poorly timed withdrawals could have on your portfolio:

Continue working. If you haven’t retired, you may want to delay your announcement until the markets have recovered. If you’ve already retired, you may want to return to the workforce so that you can temporarily suspend or reduce your withdrawals.

Add stability. As you near or enter retirement, consider adding stable solutions like guaranteed annuities3 to your portfolio. While you might lose a little growth, you can count on these assets to help sustain you during down markets.

Make adjustments. While many advisors recommend a 4% withdrawal rate during retirement, this figure is not set in stone. If your budget allows, you may be able to reduce your withdrawal rate by temporarily cutting back on expenses.

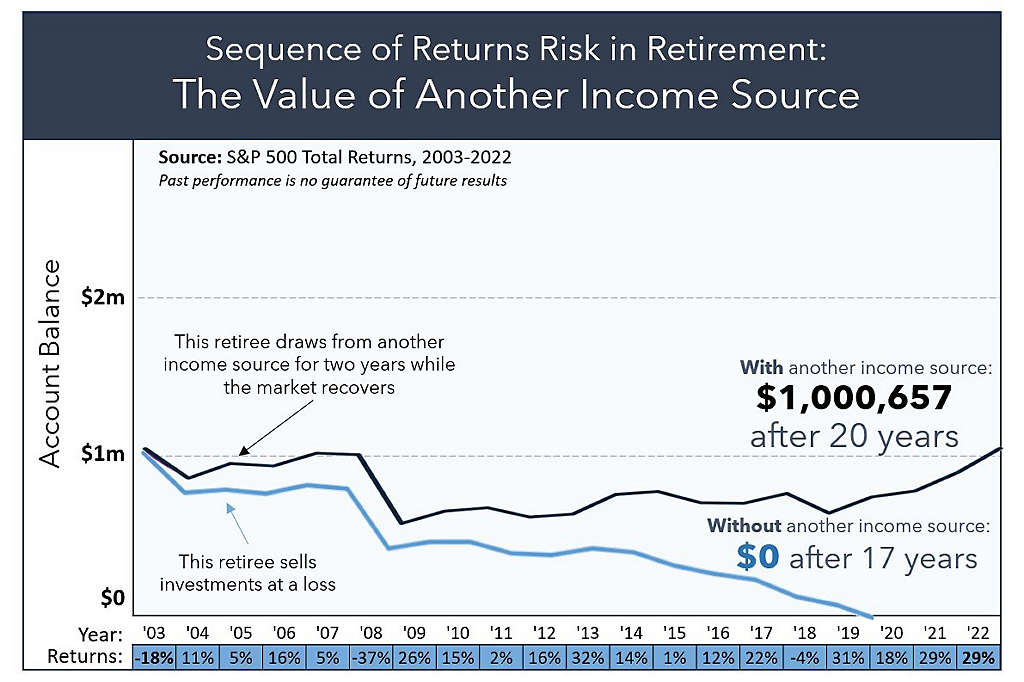

Plug the hole. Rather than sell investments during a bear market, you can use other assets—such as the cash value of a life insurance policy—to cover your expenses while you wait for the market to recover. Then, when the value of your shares has recovered, you can resume taking withdrawals.

Here’s one more chart. It depicts the “switched” scenario from earlier – when the market fell 18% in the first year of retirement – but instead of selling the shares at a loss, our investor instead uses the cash value of their life insurance policy to cover their expenses, while leaving their investments untouched for two years. After the market has recovered, they begin selling investments.

As you can see, those two years make all the difference: Instead of running out of money by year 17, they end the 20-year run with about as much money as they started with.

Frequently asked questions

While the 4% rule is a common guideline, the answer depends on several factors, including your age, health, intended lifestyle, and other financial assets. That’s why it’s so important to meet with a financial professional who can evaluate your needs and put together a realistic estimate.

As a result of the Secure Act 2.0, the mandatory withdrawal age for RMDs has risen to 73 for those born from 1951 through 1959, and to 75 for those born in 1960 or later.2

In general, you can begin to withdraw money from your retirement accounts—without penalty—at age 59½. If you withdraw funds before that time, you’ll likely have to pay a 10% IRS penalty. There is an exception for employer-sponsored plans called the rule of 55: If you leave that employer after turning 55, you can begin taking withdrawals from the plan starting at that time.

As of January 2025, the average monthly Social Security benefit was $1,976. While that may be enough to cover your basic needs (food, housing, utilities, etc.), it might not be enough to allow you to lead the lifestyle you want. If you’d like to have a realistic assessment, feel free to contact your New York Life agent.4

RELATED CONTENT

Want to learn more about income annuities and sequence-of-returns risks?

A New York Life financial professional can help determine what’s right for you.

Learn how we can help you meet your retirement goals and prepare for your family's future.

Thank you for subscribing!

1The S&P 500 is a broad-based unmanaged benchmark of the US stock market. Index results do not reflect application of taxes or investment management fees.

2Guarantees are based upon the claims paying ability of the issuing company.

3“Secure Act 2.0 – When Does the RMD Start?,” National Society of Tax Professionals, May 30, 2023: https://www.nstp.org/article/secure-act-2-0-%E2%80%93-when-does-the-rmd-start

4 “What is the average monthly benefit for a retired worker?”, Social Security Administration, January 2, 2025: https://www.ssa.gov/faqs/en/questions/KA-01903.html