CONTACT US

Get the support you need

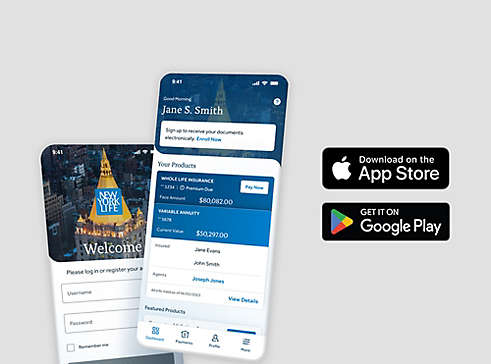

The quickest, easiest way to manage your account is online. You can view your policies and keep account details up to date, verify and update your beneficiaries, make secure payments, and more.

Make payments

If you already have an account, log in to make secure payments or update your banking information. You can also make secure, one-time payments without signing in.

Get support from a trusted agent

Find the financial professional who’s right for you. Use our locator tool to find an agent near you, or tell us more about yourself to be paired with an agent that meets your unique needs and goals.

Still have questions?

Call 1 (800)-225-5695

1 (212)-576-6600 Toll number alternative

Monday through Friday 8am to 7pm ET

Please note: we are experiencing heavy call volumes and long wait times.

If you have specific questions about your policy, claim, or application-our customer service experts are happy to help.

If New York Life provides benefits through our employer and you need assistance with your disability, life, or accidental death and dismemberment claim, please contact us at GBSClaimSolutions@newyorklife.com

If you suspect fraudulent activity is taking place, please call the fraud hotline

1-877-279-0325