Creating stability through whole life insurance with supplemental riders

When the unimaginable happened, New York Life insurance, paired with two riders, protected the Tang family financially.

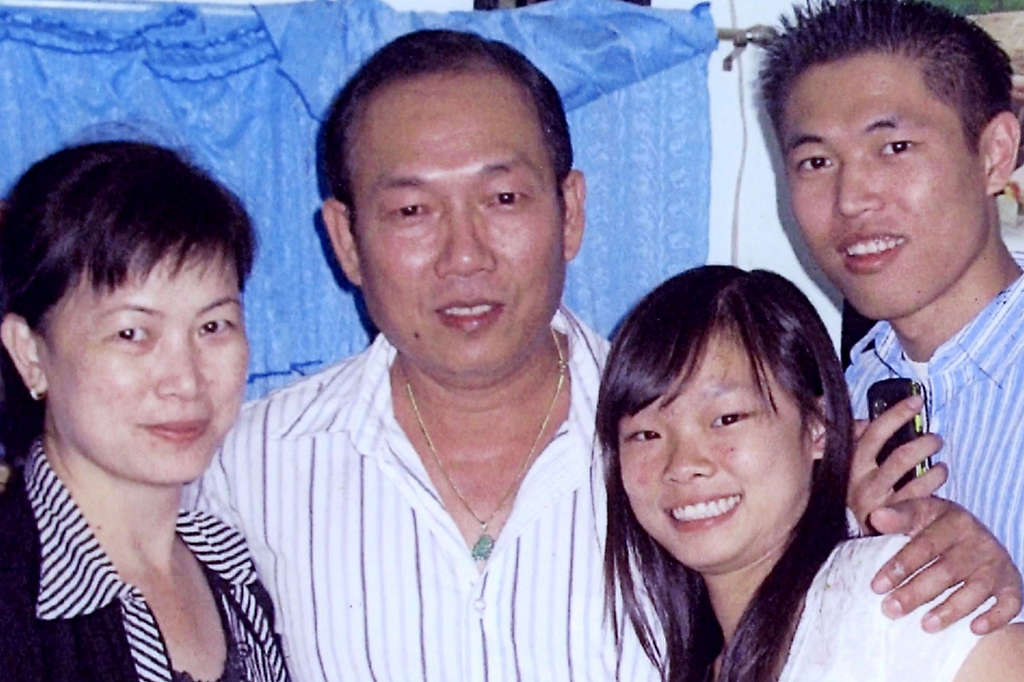

The Tang family left their home in Vietnam to build a better life in America. From left to right: Ngoc Anh, Stephen, Nancy, Jimmy.

The benefits of custom whole life insurance.

Stephen and Ngoc Anh Tang left their home in Vietnam to build a better life in Southern California for themselves and their children, Jimmy and Nancy. They were immigrants hoping to achieve the American dream. They worked hard: Stephen got a job as an hourly worker, and Ngoc Anh Tang stayed at home with their children.

Together, they made sure to set aside money for life insurance to protect their family and their dream in a new country. No one could have predicted that tragedy awaited them and that those policies would provide their children with a much-needed financial and emotional foundation as they moved into adulthood.

Life insurance supplemental riders

The first blow came when car accident tragically injured Ngoc Anh. The injuries ultimately led to her death two years later. The surviving Tangs were devastated, but Ngoc Anh’s custom whole life policy from New York Life provided stability through the grieving period. In addition, the policy had two riders that proved to be very important.

- First was the Disability Waiver of Premium rider, which covered the premiums when Ngoc Anh was in and out of the hospital. That enabled the family to maintain the policy.

- Second was the Accidental Death Benefit Rider, which doubled the benefit paid to the family because New York Life deemed Ngoc Anh’s death an accident, even though the accident that caused her death had occurred two years earlier.

The money helped the family get back on its feet. Stephen bought more insurance based on the advice of his New York Life financial professional, Annie Vu. She told him it was important to get more protection since he was a single parent.

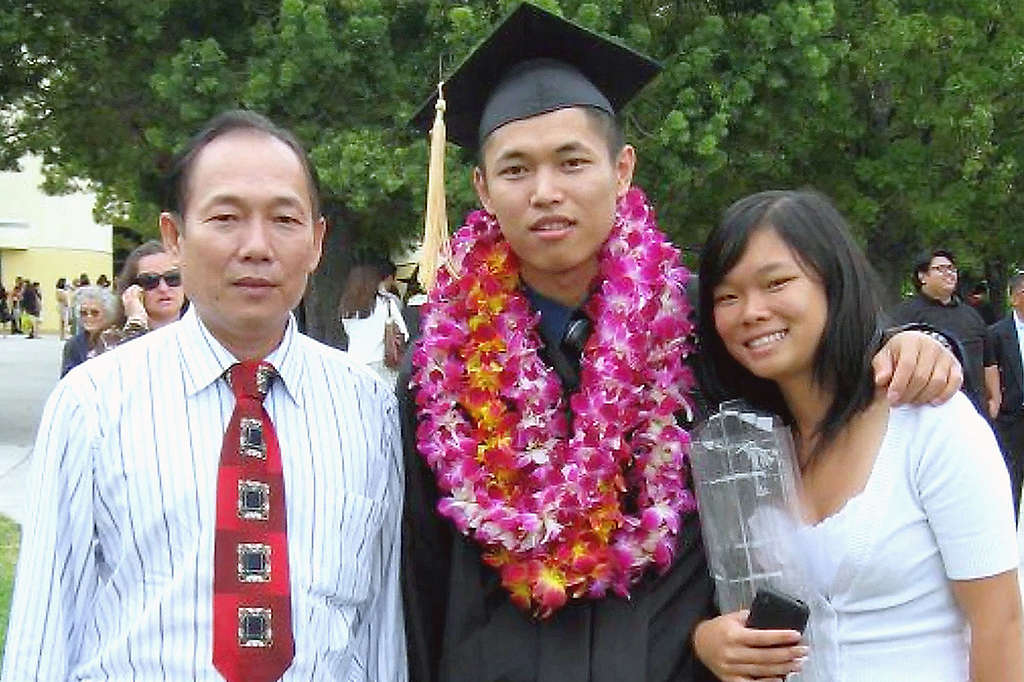

Jimmy Tang and his sister, Nancy, were able to buy a home and send Nancy to college after both parents died a few years apart.

Only three years later, the Tangs suffered another shocking blow: Stephen was diagnosed with Stage 4 liver cancer, and he died shortly thereafter. Nancy was still a senior in high school, and Jimmy was a recent college graduate.

It was traumatic for Nancy and Jimmy to lose both of their parents so unexpectedly. But they’ve been able to keep their lives on track because of the steps their parents took to protect their financial future. Nancy was able to go to college. Jimmy even bought a house near Nancy’s campus for the pair to live in.

“Without the insurance, me and Jimmy would be nowhere right now,” says Nancy. Stephen and Ngoc Anh Tang did not live to see their children’s better life in America, but through their preparation in advance, they were able to keep their children on the path they had dreamed of when they first came to this country.

RELATED CONTENT

Want to learn more about whole life insurance?

A New York Life financial professional can help determine what’s right for you.

Find out how whole life insurance provides protection along with cash value that grows.

Thank you for subscribing!

The experience of the people described in this material may not be representative of the experiences of other clients. Experiences obtained by these people are not indicative of the future experiences that may be obtained. Certain conditions must be met to exercise policy riders.

In most jurisdictions, the New York Life Custom Whole Life form number is ICC18217-50P (4/18); The Waiver of Premium Rider form number is ICC17217-225R; The Accidental Death Benefit Rider form number is ICC17217-200R. State variations apply. SMRU 182036.