What is compounding interest?

Compounding or compound interest, often called “interest on interest,” builds on both your initial investment and any previously earned interest. Read on to learn how this powerful financial tool can make your wealth grow at a faster rate over time.

What is compound interest?

Whether you’re just starting to save or are looking to enhance an existing nest egg, growing wealth is a common objective. For long-term investing, compound interest is a game changer.

Compound interest is interest that is earned on both your initial deposit (the principal) and any previously accumulated interest. This mechanism allows your money to grow faster than with simple interest, which is calculated on the principal alone and not on any of the earned interest.

How does compound interest work?

Compound interest helps money grow faster the longer it’s invested. Interest is calculated at specific intervals, known as compounding periods, which can be daily, weekly, monthly, or annually. The more frequently interest is calculated, the faster your money grows.

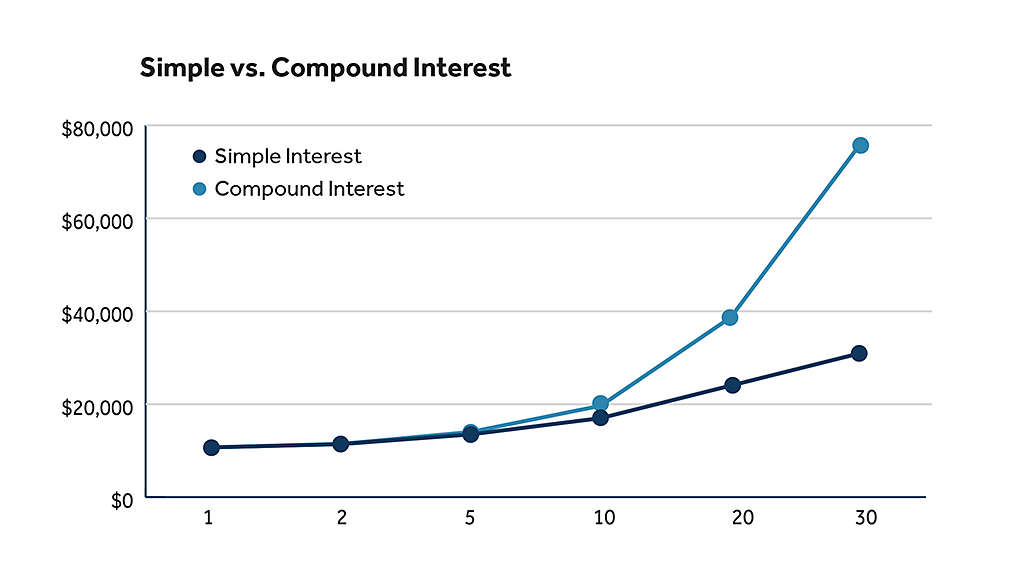

At first, the difference between compound and simple interest may seem insignificant, but over time, the power of compounding becomes evident. Consider this example: You invest $10,000 at 7% interest, compounded annually, and make no withdrawals or additional deposits. At the end of the first year, both simple and compound interest yield $700 dollars. At the end of the second year, simple interest yields another $700—while compound interest yields $749, because the 7% interest is calculated on the new balance of $10,700.

While the $49 difference may not seem significant initially, it adds up—exponentially. With each year’s interest calculation including the interest of previous years, compound interest can generate nearly $50,000 more than simple interest over 30 years in this scenario.

Simple vs. compound interest example

|

|

Simple Interest |

Compound Interest |

Power of Compounding |

|

1 |

$10,700 |

$10,700.00 |

$0.00 |

|

2 |

$11,400 |

$11,449.00 |

$49.00 |

|

5 |

$13,500 |

$14,025.52 |

$525.52 |

|

10 |

$17,000 |

$19,671.51 |

$2,671.51 |

|

20 |

$24,000 |

$38,696.84 |

$14,696.84 |

|

30 |

$31,000 |

$76,122.55 |

$45,122.55 |

Can compounding interest help with retirement savings?

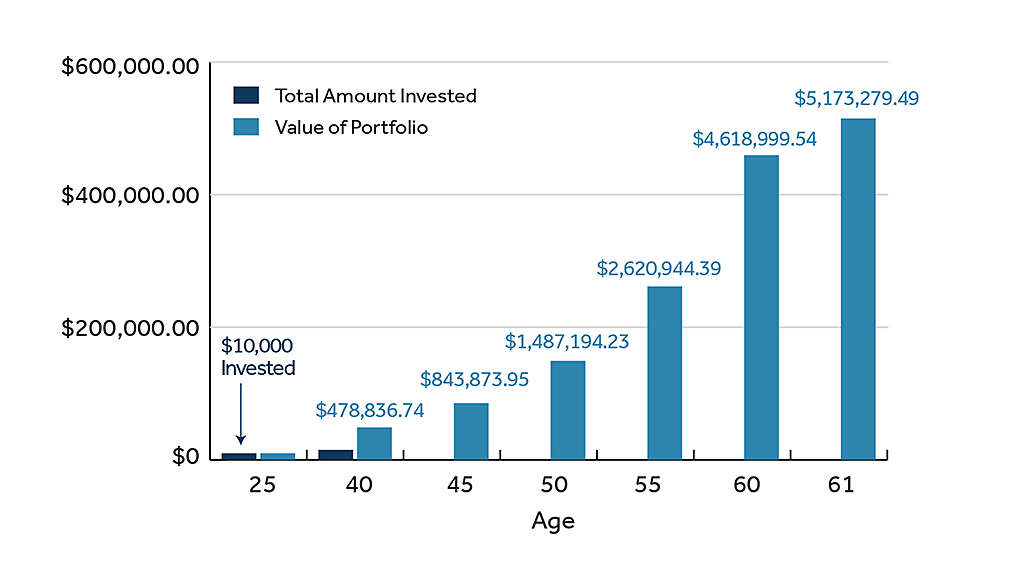

It absolutely can. Starting retirement planning early allows your investments time to take advantage of compound interest. This “superpower” is especially potent when you start early and continue to invest consistently. Applied across all the tools in your retirement strategy toolkit, such as mutual funds, IRAs, 401(k)s, and insurance policies like whole life and universal life, compounding interest can lead to substantial gains. The magic of compound interest means that someone who starts investing early can end up with a larger nest egg than someone who starts later, simply because their money has more time to grow*.

The 8-4-3 rule of compounding

The 8-4-3 rule of compounding illustrates the benefits of long-term, consistent investing and the power of compound interest over a 15-year period. The rule demonstrates how your money grows steadily during the first eight years and how growth picks up significantly during the next four years, potentially doubling your money. During the following three years, compound interest takes off, potentially quadrupling your initial investment in 15 years.

For example, if you’re 25 years old and invest $10,000 per year with an average return of 12% for 15 years, your investment could grow to about $500,000. Perhaps more impressively, even if you stop investing after 15 years and leave the money where it is, you could end up with about $5 million by age 60, assuming a 12% annual return.

Compounded investment value example

Age |

Total Amount Invested |

Value of Investment |

|

25 |

$10,000.00 |

$10,000.00 |

|

40 |

$160,000.00 |

$478,836.74 |

|

45 |

|

$843,873.95 |

|

50 |

|

$1,487,194.23 |

|

55 |

|

$2,620,944.39 |

|

60 |

|

$4,618,999.54 |

|

61 |

|

$5,173,279.49 |

Compound interest on loans

While compound interest is a great tool for growing wealth, it’s important to consider its effect on debt as well. It plays a significant role in determining payments for loans, credit cards, and mortgages. If you make only minimum payments, it takes longer to pay off the debt and you end up paying a higher amount. For this reason, some people opt to pay off loans ahead of term when finances allow. When taking a loan, you should always understand the terms including whether the repayment terms include compound interest. Credit cards, mortgages, and car loans are subject to compound interest while most student loans accrue simple interest.

RELATED CONTENT

Ready to harness the power of compound interest?

Speak with a New York Life financial professional to learn how you can put your money to work for you.

*The compounding of interest at a fixed rate of return is a hypothetical mathematical phenomenon. It is not an indication of what exactly will happen in an investor’s portfolio, which will be affected by varying rates of return, market downturns and upturns, and how investors actually manage their nest eggs in terms of holding or selling assets.