Innovation

Innovating in life insurance for 180 years and counting

New York Life | June 18, 2025

New York Life has a long history of delivering innovative solutions for our customers' ever-changing needs.

Pioneering industry firsts

Examples of New York Life’s industry firsts include:

- During the Gold Rush of 1848 to 1855, New York Life was the first to insure prospectors, something many insurance companies thought was too risky.

- In 1860, we were the first insurer to issue life insurance policies containing a nonforfeiture clause, entitling the policy owner to a prorated benefit or refund if they missed a payment.

- In 1894, New York Life became the first company to offer insurance to women at equal premium rates as men.

- In 1904, New York Life was among the early adopters of the Hollerith punched card tabulation system, an early step in data processing.

- In 1945, we introduced a formal training program for agents and managers with a varying course curriculum.

- In 1951, we became the first Mutual life insurer to invest substantially in equities.

- In 1991, we were the first U.S. insurer to offer mutual funds for institutional investors, helping to kick off what would become a multibillion-dollar industry.

- In 2012, New York Life became one of the first life insurers to launch a corporate venture capital unit (New York Life Ventures).

- In 2018, we became the first insurer to use electronic health records to accelerate the underwriting process.

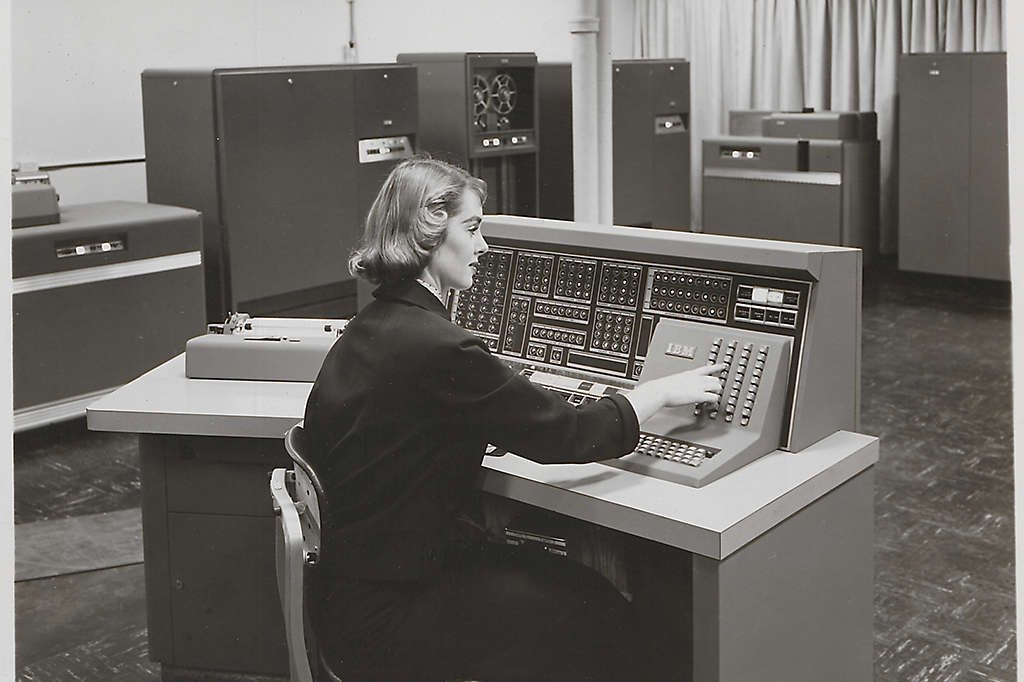

Above image: Photo of a Computer Center Operator using the control console for the IBM 702 Electronic Data Processing Machine at the 51 Madison Avenue Home Office, 1960.

Nurturing and advancing innovation

New York Life believes that the best way to nurture and advance innovation is to invest in and create a sense of ownership and empowerment across the company. Recent efforts include:

- New York Life Ventures tests and invests in emerging startup technologies to drive long-term investment returns and enable New York Life to adapt with agility and drive the future of life insurance and financial services.

- Tasked with accelerating the company’s pace of innovation, the company’s Innovation Services team helps all employees to think differently and approach their work in new ways.

- In 2016, the company established the Center for Data Science and Artificial Intelligence (CDSAi), focused on creating new ways to harness the power and intelligence of our extensive data, while providing learning opportunities for employees interested in data science.

- In 2017, New York Life added the Life Insurance Fast Track Program (LIFT) which allowed eligible clients to bypass the Expanded Blood Draw (EBD), a first in underwriting.

- New York Life’s Strategic Businesses drive innovation by embracing new technologies and building new capabilities. The businesses effectively serve as testing grounds where new capabilities can be developed, refined, and exported to other areas of the company.

- To foster digital thinking, our Data Science Academy features two educational tracks for employees. The technical track helps employees improve their skillsets in statistical modeling and machine learning, while the business track introduces employees to case studies involving analytic solutions.

- New York Life’s Data Experience (DX) initiative is an investment in the company’s data strategy in which we focus on creating and governing shareable trusted data and analytical assets to drive actionable business insight.

- Our Center for Data Science and Artificial Intelligence provides data science and artificial intelligence expertise, solutions and education, and works in close collaboration with our internal business partners to support automated, data analytics-driven decisions in many transactions and processes and, thereby, create incremental business value for New York Life.

Innovating to better serve policy owners

Innovation is not just about efficiencies and adopting new technologies. Our most powerful driver for innovation is the desire to create better customer experiences and solve the diverse needs of our policy owners. Examples include:

- In 1956, we made it easier to pay premiums by offering automatic bank withdrawals and automatic payroll deductions.

- In 1978, the Field Access Communications Terminal System (FACTS) was launched. It connected all of our offices to a centralized data processing center, allowing field representatives quick access to policy owner information.

- In 1982, we developed the Option to Purchase Paid-Up Additions (OPP), which allows policy owners to purchase additional coverage (without medical checkups) with out-of-pocket money to meet their changing needs – subject to certain limits. This additional coverage is fully guaranteed and also earns dividends.

- In 1985, New York Life began offering Mutual Funds. A year later, the company launched MainStay, our own proprietary line of funds.

- In 1994, we partnered with the American Association of Retired Persons (AARP) to become the 32 million member organization’s exclusive and endorsed life insurance provider.

- In 1999, we introduced Asset Preserver, a linked benefit policy of long-term care coverage and life insurance.

- In 2000, we launched an online customer service platform offering services over the internet.

- In 2006, we introduced Custom Whole Life Insurance, a whole life product with flexibility on premium paying terms.

- In 2011, we introduced a Level Convertible Term product offering clients flexibility to choose how long their policy would have a uniform premium

- In 2018, we introduced NYL My Care, a new long-term care solution that makes the purchase of long-term care insurance simpler and more likely within your personal budget.

- In 2022, we launched Wealth Plus, two new innovative whole and variable universal life insurance solutions designed to provide death benefit protection and early, tax-advantaged cash value accumulation potential, enabling clients to further maximize the benefits of life insurance as part of their financial strategy.

New York Life’s ongoing track record of innovation enables the company to deliver consistently strong financial performance, sustain competitive advantage, and remain an industry leader.

We remain committed to innovating while continuing to provide our policy owners with financial security and peace of mind.

RELATED CONTENT

Go back to our newsroom to read more stories.

Media contact

Kevin Maher

New York Life Insurance Company

(212) 576-7937

Kevin_B_Maher@newyorklife.com